The VerifiMe® Blog

Stay informed with the latest insights on digital identity, compliance, and verification.

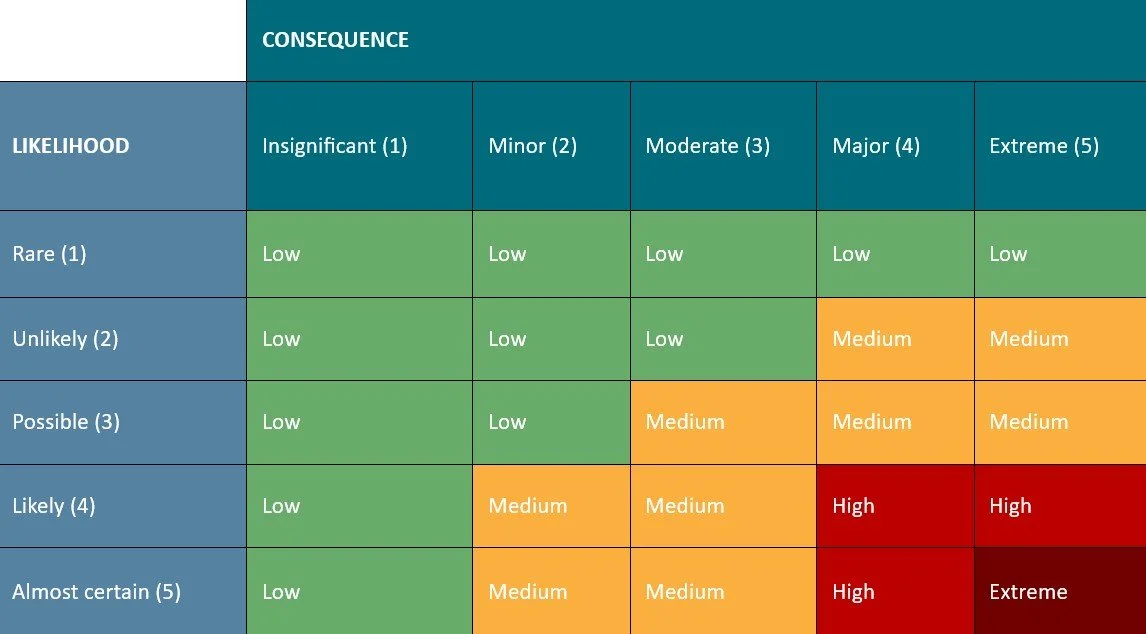

What Is Risk Assessment and Why Your Practice Needs It by July 2026

What Is Risk Assessment and Why Your Practice Needs It by July 2026

A foundational guide for accountants and lawyers preparing for Tranche 2 AML/CTF compliance

05 Nov 25

Leading by Example: How Confidant Partners is Preparing for AML/CTF Tranche 2

Leading by Example: How Confidant Partners is Preparing for AML/CTF Tranche 2

When professional advisors help clients navigate regulatory change, their own compliance approach matters. Here's how Confidant Partners is implementing the same rigorous standards they recommend.

10 Oct 2025

AML/CTF Tranche 2: Frequently Asked Questions for Accounting Practices

A comprehensive FAQ for accountants and anyone in the industry covering everything from the basics to addressing real concerns we hear from accountants all the time regards what the AML/CTF Tranche2 regulations mean.

09 Oct 2025

How Shareable Digital Identity Benefits the Tranche 2 Regulated Real Estate Market

Shareable Digital Identity for Real Estate Compliance.

The blog outlines a proposed system for shareable digital identity to transform compliance procedures within the Australian real estate market, particularly for property bidders. This innovation centres on a "Verify Once, Share Many Times" model where a bidder's initial, comprehensive verification (including document checks, biometrics, and sanctions screening) generates a secure, reusable digital credential.

29 Sep 2025

What Accountants Need to Know About Tranche 2 Reporting Obligations

AML/CTF Tranche 2: Customer Due Diligence for Accounting Practices - From 1 July 2026, Australian accounting practices providing "designated services" must comply with new anti-money laundering and counter-terrorism financing (AML/CTF) requirements under Tranche 2 reforms.

24 Sep 25

Strategic Alignment: National Identity Proofing Guidelines and AML-CTF Reforms

The 2025 National Identity Proofing Guidelines and the upcoming AML-CTF reforms demonstrate remarkable strategic alignment, creating a unified approach to identity verification and compliance that will reshape how Australian businesses manage customer due diligence.

Is the timing coincidental. The 2025 National Identity Proofing Guidelines take effect precisely as new AML-CTF customer due diligence requirements prepare for implementation on March 31, 2026. This strategic synchronisation provides regulated entities with clear, consistent standards for meeting both identity verification and compliance obligations under a single, coherent framework.

19 Sep 25

Adverse Media Screening: A Critical Component of Modern Customer Due Diligence

In today's rapidly evolving regulatory landscape, financial institutions and businesses face mounting pressure to implement robust compliance measures. Among these, adverse media screening has emerged as an indispensable tool for comprehensive customer due diligence (CDD) and anti-money laundering (AML) programs. But what exactly is adverse media screening, and why has it become so crucial for modern risk management?

10 Sep 2025

AML/CTF Tranche 2: Customer Due Diligence and Mandatory Reporting for Law Firms

From 1 July 2026, Australian law firms must comply with AML/CTF Tranche 2 requirements. If your practice handles real estate transactions, manages client funds, or creates trusts and corporate structures, you'll become an AUSTRAC reporting entity.

That means implementing customer due diligence (CDD), conducting beneficial ownership verification, screening for politically exposed persons (PEPs) and sanctions, and submitting suspicious matter reports (SMRs) and threshold transaction reports (TTRs).

16,000 Australian law firms face this compliance challenge. Most are asking: How do we implement AML/CTF requirements without re-verifying clients repeatedly across every matter?

07 Oct 25

Helping Xcend Create a Safer and More Trusted Framework for Users of Their Cuspy Platform

In today's rapidly evolving financial landscape, the potential for fraud—both opportunistic and sophisticated—is a rising issue. This is particularly so for securities registry platform operators.From today, Xcend is introducing a new feature to their registry management platform Cuspy. Having recognised that a key vulnerability lies within online services and platform access, they've partnered with VerifiMe to create a comprehensive solution.

08 Aug 2025